Wage Calculator Michigan

Enter any overtime hours you worked during the wage period. Calculate your Michigan net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Michigan paycheck calculator.

Pin On Coronavirus In Michigan

This Michigan hourly paycheck calculator is perfect for those who are paid on an hourly basis.

Wage calculator michigan. Michigan pipe trades federal candidate questionnaire. Wage loss reimbursement is one of the many essential No Fault also known as PIP insurance benefits that Michigan. The tool provides information for individuals and households with one or.

Formula created by Court Of Appeals in Agnone v. The assumption is the sole provider is working full-time 2080 hours per year. Third Party Recovery Offset.

DOI ON OR AFTER 12192011. The W-4 form is not a substitute for the MI-W4. Updated January 12 2021.

Advance Pay Last Falling Due. Federal labor law requires overtime hours be paid at 15 times the normal hourly rate. Select a link below to display the living wage report for that location.

Free Michigan Payroll Tax Calculator and MI Tax Rates. The weekly benefit amount is calculated by dividing the sum of the wages earned during the highest quarter of the base period by 26 rounded down to the next lower whole dollar. Michigan pipe trades state candidate questionnaire.

This free easy to use payroll calculator will calculate your take home pay. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. So if you earn 10 an hour enter 10 into the salary input and select Hourly Optional Select an alternate state the Michigan Salary Calculator uses Michigan as default selecting an alternate state will use the tax tables from that state.

The federal minimum wage is 725 per hour and the Michigan state minimum wage is. Calculate Number of Weeks. Living Wage Calculation for Oakland County Michigan The living wage shown is the hourly rate that an individual in a household must earn to support his or herself and their family.

You must claim withholding exemptions for Michigan income taxes by filing Form MI-W4. Living Wage Calculation for Calhoun County Michigan. Whether youre cooking up the next big coney dog stand or making t-shirts for the Red Wings one thing all small businesses have in common is that.

Families and individuals working in low-wage jobs make insufficient income to meet minimum standards given the local cost of living. The living wage shown is the hourly rate that an individual in a household must earn to support his or herself and their family. August 6 2015 by Steven M.

To use our Michigan Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. Enter your salary or wages then choose the frequency at which you are paid. W4 Employee Withholding Certificate The IRS has changed the withholding.

The result cannot exceed the utmost weekly benefit permitted by rule. Calculate by Date Range. According to the Small Business Association there are over 870000 small businesses in Michigan and they account for 996 of all businesses in the state.

The assumption is the sole provider is working full-time 2080 hours per year. Living Wage Calculation for Michigan. Counties and Metropolitan Statistical Areas in Michigan.

Supports hourly salary income and multiple pay frequencies. Michigan pipe trades federal candidate questionnaire. Show results for Michigan as a whole.

In Michigan overtime hours are any hours over 40 worked in a single week. Advance Pay Balance Due. The tool provides information for individuals and households with one or two working.

Paycheck Results is your gross pay and specific deductions from your paycheck Net Pay is your take-home pay and Calculation Based On is the information entered into the calculator. After a few seconds you will be provided with a full breakdown of the tax you are paying. Calculates Federal FICA Medicare and withholding taxes for all 50 states.

Advance Pay Next Falling. As with federal taxes your employer withholds money from each of your paychecks to put toward your Michigan income taxes. Michigan Hourly Paycheck Calculator Results Below are your Michigan salary paycheck results.

The living wage shown is the hourly rate that an individual in a household must earn to support his or herself and their family. The Michigan Minimum Wage is the lowermost hourly rate that any employee in Michigan can expect by law. DOI PRIOR TO 12192011.

Michigan Overtime Wage Calculator. Michigan collects a state income tax and in some cities there is a local income tax too. Home-Owners short-changes high-wage earning auto accident victims.

Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay. There are legal minimum wages set by the federal government and the state government of Michigan. We developed a living wage calculator to estimate the cost of living in your community or region based on typical expenses.

Michigan pipe trades state candidate questionnaire. The tool helps individuals communities and employers determine a local wage rate that allows residents to meet minimum standards of living. How to calculate Michigan No Fault wage loss benefits after returning to work.

The assumption is the sole provider is working full-time 2080 hours per year. The results are broken up into three sections. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs.

An Example Of A W 4 Form And About How To Fill Out Various Important Sections Best Tax Software Jobs Worksheet Tax Refund

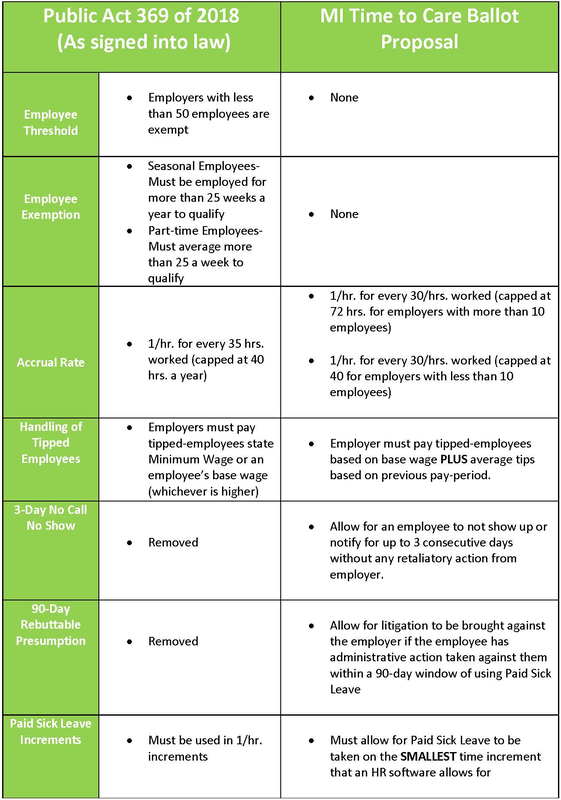

What You Need To Know About Michigan S New Minimum Wage Sick Pay Laws Mlive Com

Profit Material Cost Tumbler Excel Spreadsheet Digital Download Read Entire Description Excel Spreadsheets Spreadsheet Facebook Business

Don T Leave Michigan S Hospitality Industry Out In The Cold Michigan Restaurant Lodging Association

What You Need To Know About Michigan S New Minimum Wage Sick Pay Laws Mlive Com

Paid Sick Leave Michigan Restaurant Lodging Association

What Questions Are Asked At A Workers Comp Hearing Here Are The Top 6 1 General Background Que What If Questions This Or That Questions Medical Questions

Michigan Salary Calculator 2021 Icalculator

Michigan Sales Tax Calculator Reverse Sales Dremployee

Advance Michigan Catalyst Workforce Intelligence Network Workforce Intelligence Network

Don T Leave Michigan S Hospitality Industry Out In The Cold Michigan Restaurant Lodging Association

20 States Increased Minimum Wage In 2021 What Would You Make Small Business Seo Minimum Wage Wage

What Is Local Income Tax Income Tax Income Tax

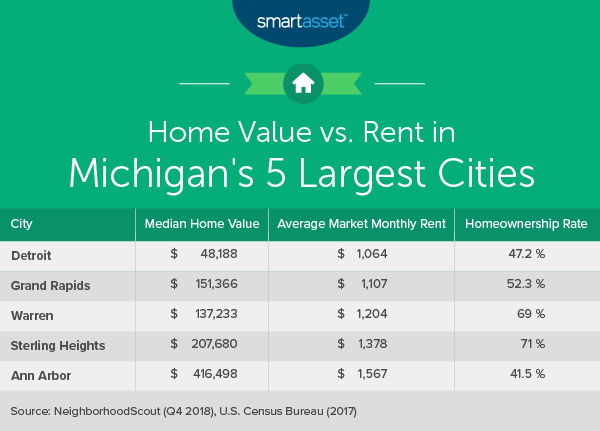

Michigan Income Tax Calculator Smartasset

Calculate Child Support Payments Child Support Calculator After 12 Years In F Child Support Calcu Child Support Payments Child Support Child Support Quotes

The Cost Of Living In Michigan Smartasset

Michigan Workers Compensation Rates 2020

Post a Comment for "Wage Calculator Michigan"