Wage Calculator Manitoba

According to the Manitoba government the minimum wage in Manitoba will increase from 1045 per hour to 1125 per hour on September 1 2017. Generally most people think of a month as having 4 weeks.

Welder Average Salary In Canada 2021 The Complete Guide

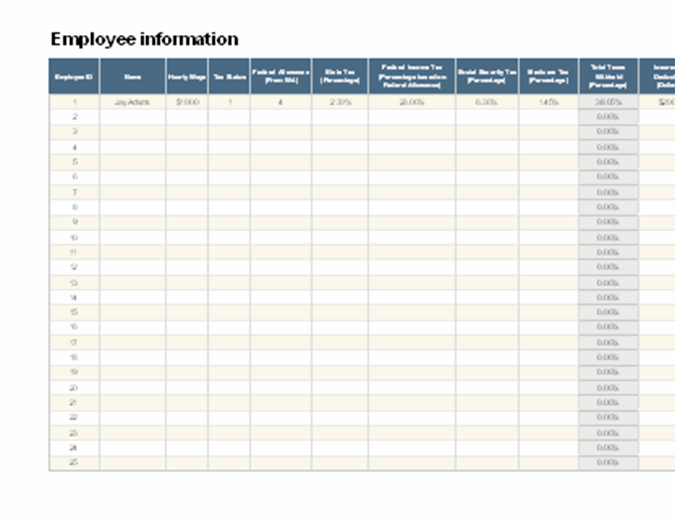

It will confirm the deductions you include on your official statement of earnings.

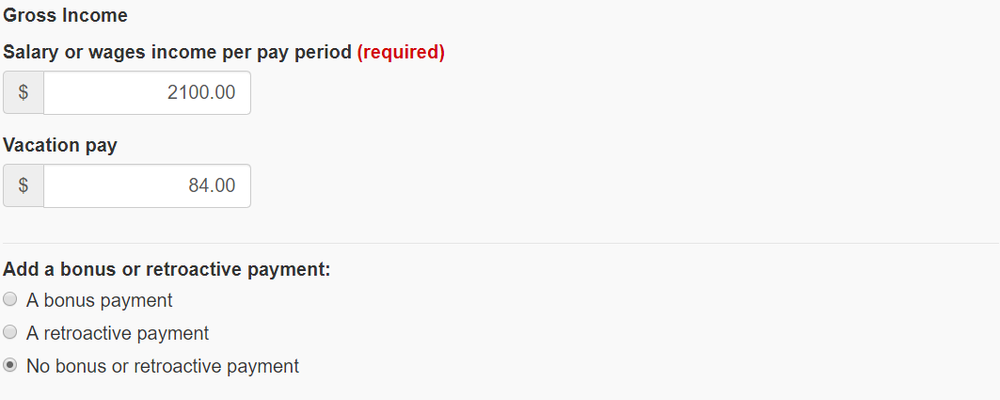

Wage calculator manitoba. What is the minimum wage in Manitoba. The CCPA MB living wage is calculated as the hourly rate at which a household can meet its basic needs once government transfers have been added to the familys income such as the Canada Child Benefit CCB and deductions have been subtracted such as income taxes and Employment Insurance premiums. The result shows what your gross earnings would be.

That means that your net pay will be 38826 per year or 3235 per month. If you make 52000 a year living in the region of Ontario Canada you will be taxed 11488. The overall concept behind this calculator is to give managers and managers an edge of reference for wages in the region they live and work in.

This marginal tax rate means that your immediate additional income will be taxed at this rate. Gross pay is what you make before any deductions are made taxes etc. Income Tax calculations and RRSP factoring for 202122 with historical pay figures on average earnings in Canada for each market sector and location.

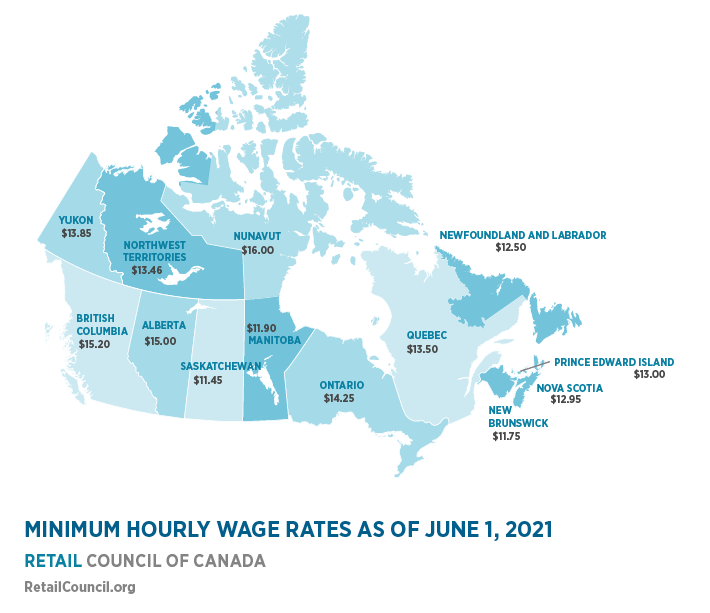

If you make 52000 a year living in the region of Manitoba Canada you will be taxed 13174. Thats among the lowest in Canada with only New Brunswick and Saskatchewan having lower minimum wages at 1170 and 1145 respectively. PaymentEvolution provides simple fast and free payroll calculator and payroll deductions online calculator for accountants and small businesses across Canada.

The reliability of the calculations produced depends on the accuracy of the information you provide. In an effort to protect the welfare of the workers the minimum wage in Manitoba is set according to the federal minimum wage. The Manitoba Income Tax Salary Calculator is updated 202122 tax year.

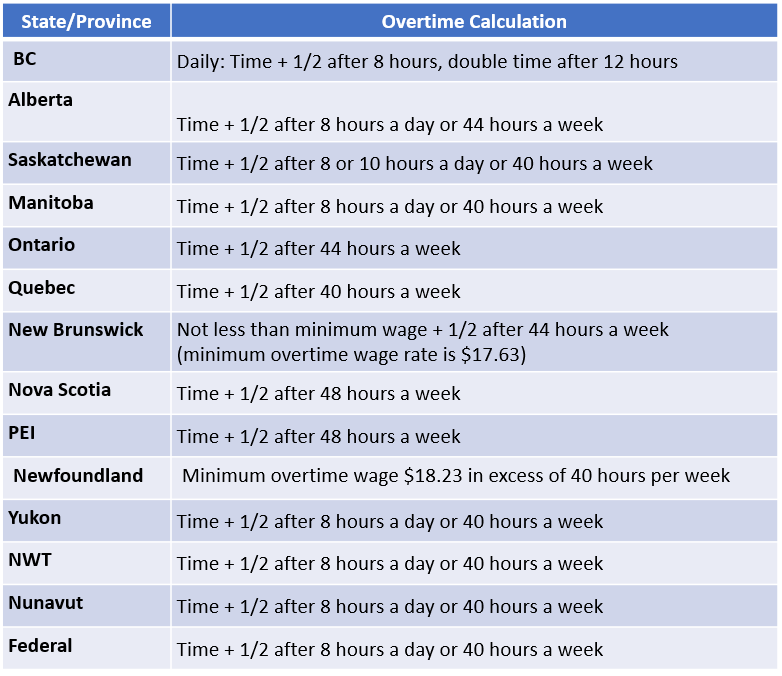

As mentioned above Manitobas overtime threshold is fairly straightforward which makes it fairly easy to calculate overtime. As of 2021 the minimum wage in Manitoba is 1190 up from 1165 in 2020. Fill in the boxes below that apply to you to convert your actual pay or your payrate.

You assume the risks associated with using this calculator. You have to enter the working hours per week and Holiday Statutory weeks then click on the Calculate button. Salary calculations include gross annual income tax deductible elements such as Child Care Alimony and include family related tax allowances.

This marginal tax rate means that your immediate additional income will be taxed at this rate. Youll then get a breakdown of your total tax liability and take-home pay. Net annual salary Weeks of work year Net weekly income.

Employers simply need to pay employee 1½ times their regular rate of pay for any hours worked over 8 hours in a day or 40 hours in a week whichever is greater. Calculating Overtime Pay Manitoba. The Manitoba Salary Calculator uses personal income tax rates from the following tax years 2021 is simply the default year for the Manitoba salary calculator please note these income tax tables only include taxable elements allowances and thresholds used in the Canada Manitoba Income Tax Calculator if you identify an error in the tax tables or a tax credit threshold that you would like us to add to the tax calculator.

Whats The Minimum Wage In Manitoba. After entering all basic data on working hours per week and Holiday Statutory weeks as required and clicking on the Compute button the calculator will work out the amount of minimum wage and distinguish it with the wages payable with check whether the minimum wage. Easy income tax calculator for an accurate Manitoba tax return estimate.

That means that your net pay will be 40512 per year or 3376 per month. Your average tax rate is 221 and your marginal tax rate is 349. Formula for calculating net salary.

Enter your pay rate. Keep in mind that general holidays vacation leave and paid sick time are all considered hours of work for the purpose of calculating. Simply enter your annual or monthly income into the tax calculator above to find out how taxes in Canada affect your income.

Also known as Gross Income. The annual net income is calculated by subtracting the amounts related to the tax Canada Tax and Ontario Tax the Ontario surtax the Canadian Pension Plan the Employment Insurance. However the minimum wage will be adjusted each year on September 1.

Your 2020 Manitoba income tax refund could be even bigger this year. The federal government set the minimum wage at 11 per hour effective July 1 2018. Usage of the Payroll Calculator.

Use our Minimum wage calculator in Manitoba. The calculator is updated with the tax rates of all Canadian provinces and territories. Our minimum wage calculator Manitoba is a basic tool to help businesses and employees to appropriately calculate the minimum wage for the more common work patterns for starter reference purposes.

Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. You can use the calculator to compare your salaries between 2017 2018 2019 and 2020. Eligible employers will receive a grant equivalent to 50 per cent of wages for a maximum of 10 employees with a maximum of 5000 per employee.

There are 12 months and 52 weeks in a year. Salary Before Tax your total earnings before any taxes have been deducted. Your average tax rate is 253 and your marginal tax rate is 385.

Gross annual income - Taxes - Surtax - CPP - EI Net annual salary. Enter your annual income taxes paid RRSP contribution into our calculator to estimate your return. The amount can be hourly daily weekly monthly or even annual earnings.

This calculator provides an overview of the annual minimum wage for workers in Manitoba excluding the compensation of days off and holidays thus the annual hours worked To calculate only the minimum annual salary including holidays simply indicate 0 in the field Holiday Statutory weeks Do you like Calcul Conversion. Annual salary calculator for the minimum wage in Manitoba for 2021. Under the Healthy Hire Manitoba Program local employers can apply for up to 50000 in provincial support to help cover the wages of new employees who can attest they have been vaccinated intend to be vaccinated or are unable to be vaccinated.

Canada Global Payroll And Tax Information Guide Payslip

Minimum Wage By Province Retail Council Of Canada

Q A Minimum Wage 15 H Wage In Manitoba

What Minimum Wage Critics Don T Want You To Know Minimum Wage Wage Mcmaster University

2021 Salary Calculator Robert Half

Workers Compensation Perspectives Are Wages Or Salary Fully Covered By Workers Compensation Insurance

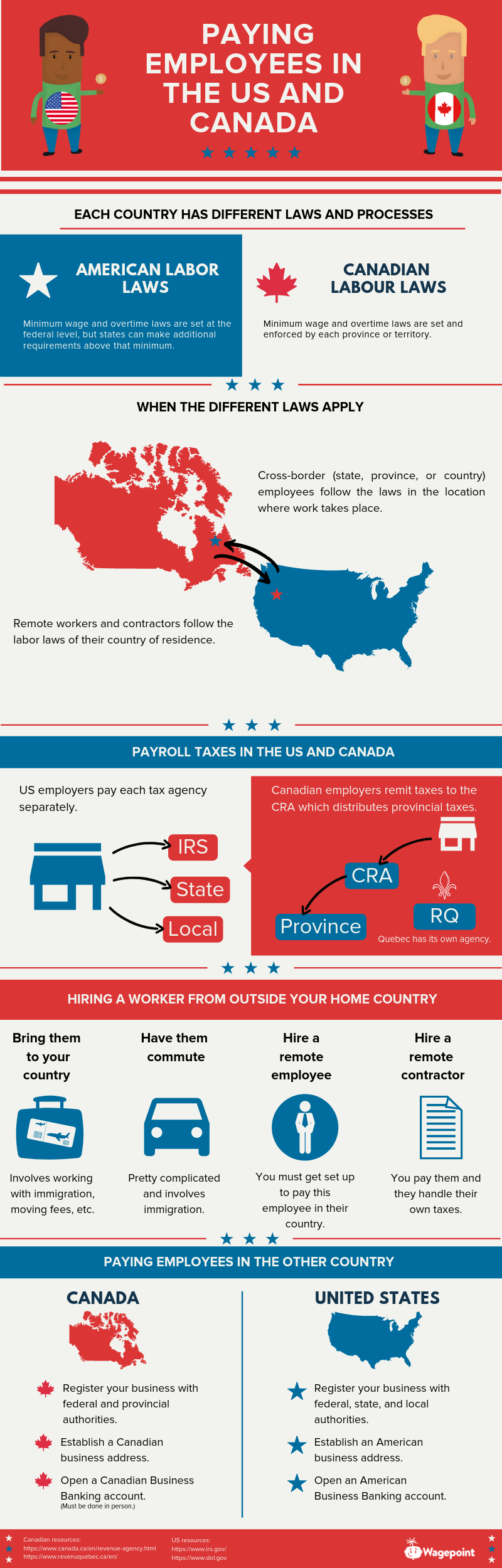

Paying Employees In Canada And The Us What You Need To Know Smallbizclub

How To Calculate Payroll Tax Deductions Monster Ca

Petition Fight For 15 Bc Petition Wage Minimum Wage

How To Calculate Canadian Payroll Tax Deductions Guide Youtube

Welder Average Salary In Canada 2021 The Complete Guide

2021 Manitoba Province Tax Calculator Canada

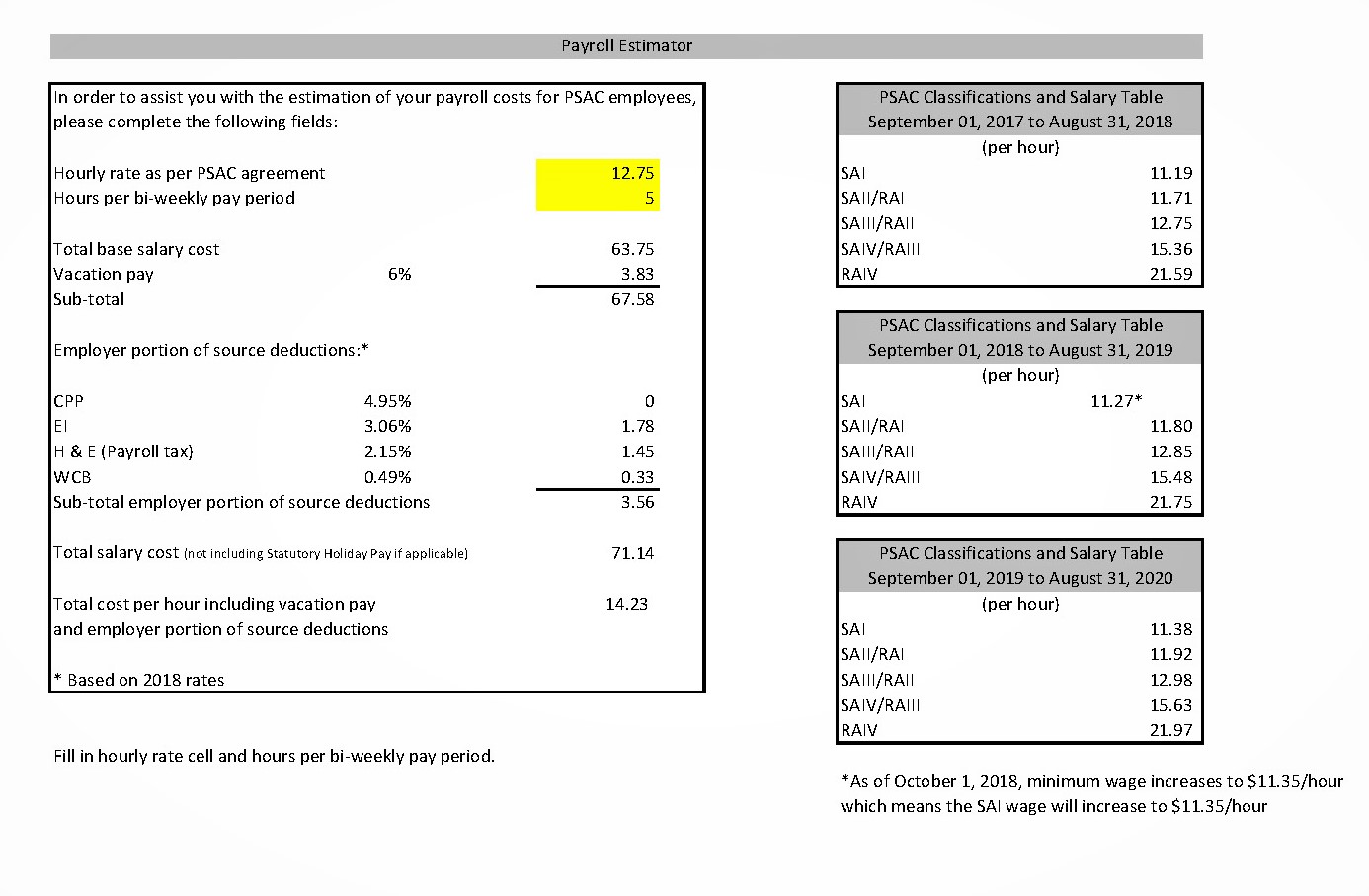

Payroll Estimator Human Resources

Welder Average Salary In Canada 2021 The Complete Guide

How To Use The Cra Payroll Deductions Calculator Avalon Accounting

A Family Living Wage For Manitoba Canadian Centre For Policy Alternatives

Everything You Need To Know About Running Payroll In Canada

Gross Vs Net Income Financial Infographic From Accc Learn More About Personal Finances To Better Mana Net Income Debt Relief Programs Credit Card Debt Relief

Post a Comment for "Wage Calculator Manitoba"