Gross Salary Include Bonus

Bonus is mendatory if the Salary is not above 10000 and will be calculated on Rs. So Net Salary Gross Salary Deductions Rs83000 Rs13000 Rs70000.

Gross Salary Simplified Definition Components Calculation Razorpayx Payroll

Unfortunately it isnt and you must include your bonuses on your tax return.

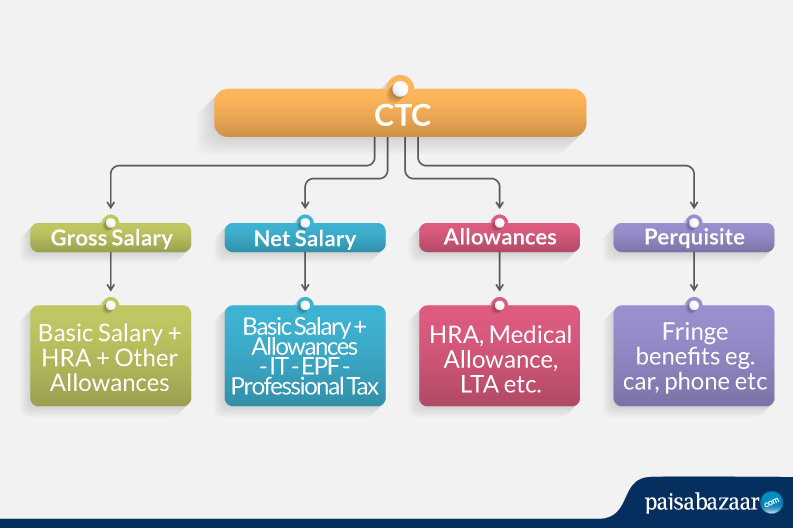

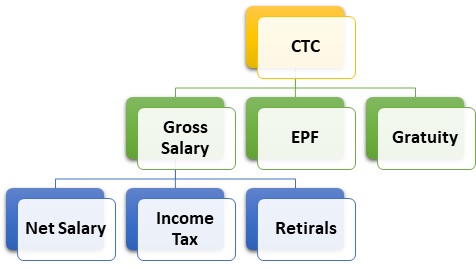

Gross salary include bonus. What Is Gross Pay and How Is It Different From Your Salary or Net Pay. It is your cost to the company CTC. Collection of ESI Contribution.

It is the employers responsibility to contribute to the ESI fund by deducting the employees contribution from wages and combining it with their own contribution. It comprises basic wages overtime pay commissions tips other allowances and one-twelfth of annual bonuses. For example if your employer agrees to pay you 6000000 per year without bonuses that will be your gross income.

If youve received bonuses as well as your salary you will need to include the full amount you received before taxes in bonuses when you calculate your gross salary amount. How it will be reflected in Salary Slip if it is paid monthly by principle employer. For example you will have to deduct HRA exemption any home loan EMI investments under section 80C and 80D and similar such things for.

Whats not included in gross pay for KiwiSaver. Gross Salary is employee provident fund and gratuity subtracted from the Cost to Company CTC. Calculation of bonus will be as follows.

Annual compensation in the simplest terms is the combination of your base salary and the value of any financial benefits your employer provides. 2Gross salary includes pf contribution of employee only. If a company pays statutory bonus of Rs 292- on monthly basis to all contract employees skilled level than would that Statutory Bonus get added in Gross Salary and subsequently attract ESIC 475 on same.

Or will it not be added to gross. The gross monthly salary however does not include Annual bonus such as Diwali bonus Retrenchment compensation and Encashment of leave and gratuity. Please check below section 21 of bonus ACT about the salary and Wages means under this act.

For employees it refers to the gross monthly wages or salaries before deduction of employee CPF contributions and personal income tax. Annual bonuses or commissions. De minimis means that the benefit is so small in value that it would be unreasonable and impracticable for your employer to account for it from an administrative standpoint.

When your employer provides you with a bonus they will report it on your W-2 in box 1but its combined with your normal wages or salary. For calculation of Income Tax gross salary minus the eligible deductions are considered. Hi Sunita The components of the salary break up may be as below you can prepare it at the suitability of your own.

2019 Bonus Tax Rate. On the other hand the salary that an employee takes home is the net salary after deductions. Gratuity is an honorarium token amount that is paid to the employer for the services offered during the employment tenure.

For self-employed persons gross monthly income refers to the average monthly profits from their. 3500 Min 833 to Max 20 But if your salary exceeds 10000 then it is on employers will. If BasicDA is below Rs7000 then the bonus will be calculated on the actual amount.

Taxation Process of Gross Salary. Taxation Process of Gross Salary. If the gross earning of your employees is below Rs21000 you are eligible to pay bonus.

Calculation of bonus will be as follows. For example bonuses given in the form. To put it in simpler terms Gross Salary is the amount paid before the deduction of taxes or other deductions and is inclusive of bonuses overtime pay holiday pay and other differentials.

HRA would be 40 or 50 of basic. Basic salary is not the same as gross salary gross salary is the total of all the money you are being paid for doing your job. Any other remuneration of any kind before tax for example taxable benefit allowances.

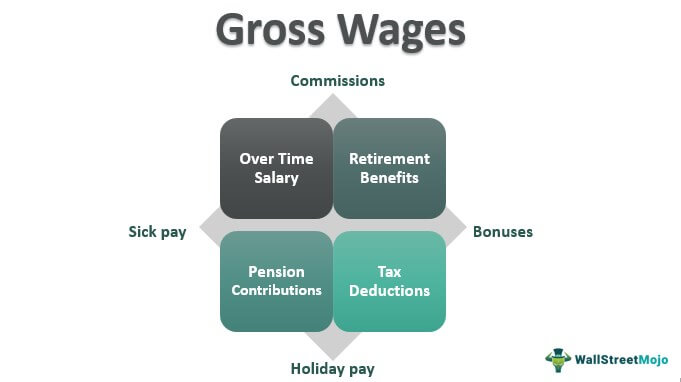

Components of Gross Salary. Employer contribution towards PF does not form a part of gross salary 28th February 2008 From India Delhi. Although the percentage method of calculating income tax on your bonuses assesses a 22 percent tax this applies to taxpayers that.

To calculate Income Tax gross salary minus the eligible deductions are considered. In the eyes of the Internal Revenue Service your bonus is no different than the salary you receive. Therefore Net Salary Gross Salary Deductions Rs70000 Rs14000 Rs56000.

Gross salary includes income from all sources and is not confined to only the income received in cash. This will inevitably increase your adjusted gross income or AGIwhich can potentially increase the amount of tax you owe. And if your employer doesnt give you a bonus.

The components of a gross salary include several benefits some of which are elaborated below. It can be good to know your gross pay but its not the best indicator of how. Basic HRA 40 - 50 is exempted from Taxes depends.

Payments included in gross pay for KiwiSaver schemes. Your employer must include the value of cash bonuses paid to you in your gross wages. In simpler terms Gross Salary is the amount which is given to the employee including festive and annual bonus leave encashments etc before the deduction of any kind of tax whatsoever.

This is the minimum amount an employee can expect to receive from their salary after tax and before any bonuses. For instance you will have to deduct HRA exemption any home loan EMI investments under section 80C and 80D and similar such things for. Non-cash bonuses also called de minimis benefits are excluded from your gross income.

For KiwiSaver schemes gross pay is total salary or wages including. Therefore it also includes benefits or services received by an employee.

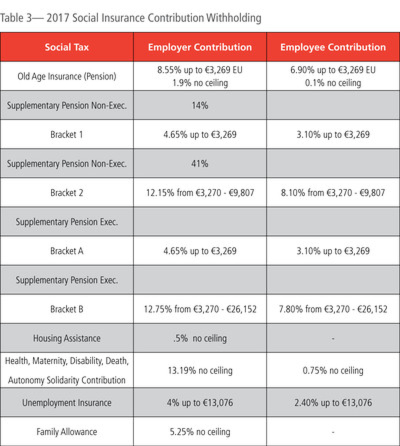

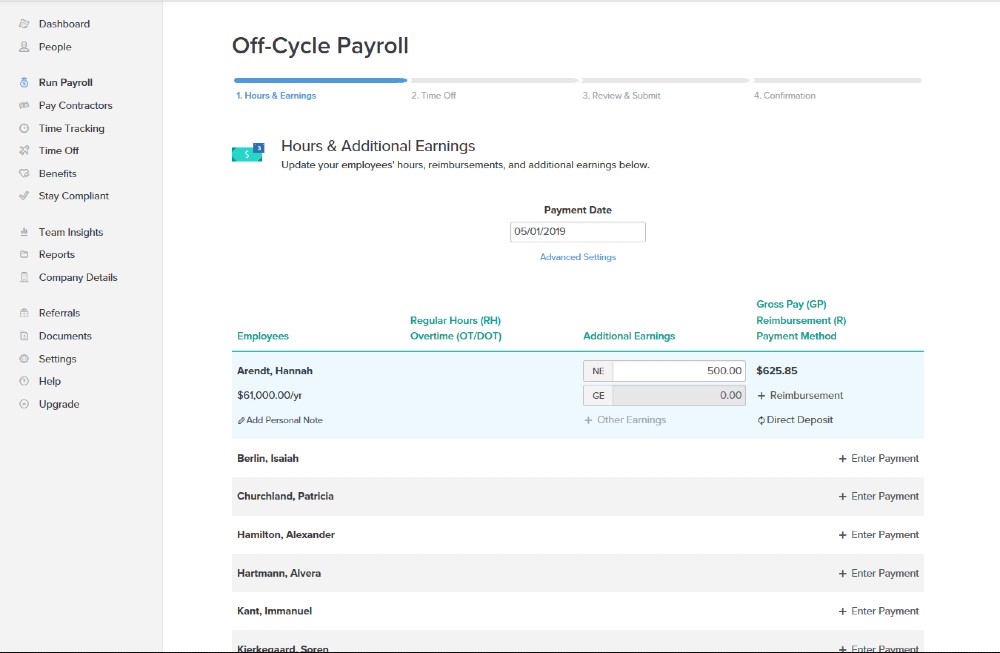

Country Spotlight What To Know About Payroll In France

Is The Variable Pay Part Of A Gross Salary Quora

Gross Salary Vs Net Salary Top 6 Differences With Infographics

Gross Wages Meaning Examples How To Calculate

What Is Base Salary Definition And Ways To Determine It Snov Io

China Annual Bonus Tax Calculator Easier Cloud Accounting Business Megi

Gross Salary Definition Importance Example Human Resources Hr Dictionary Mba Skool Study Learn Share

Pr Application Basic Salary And Gross Salary Singapore Expats Forum

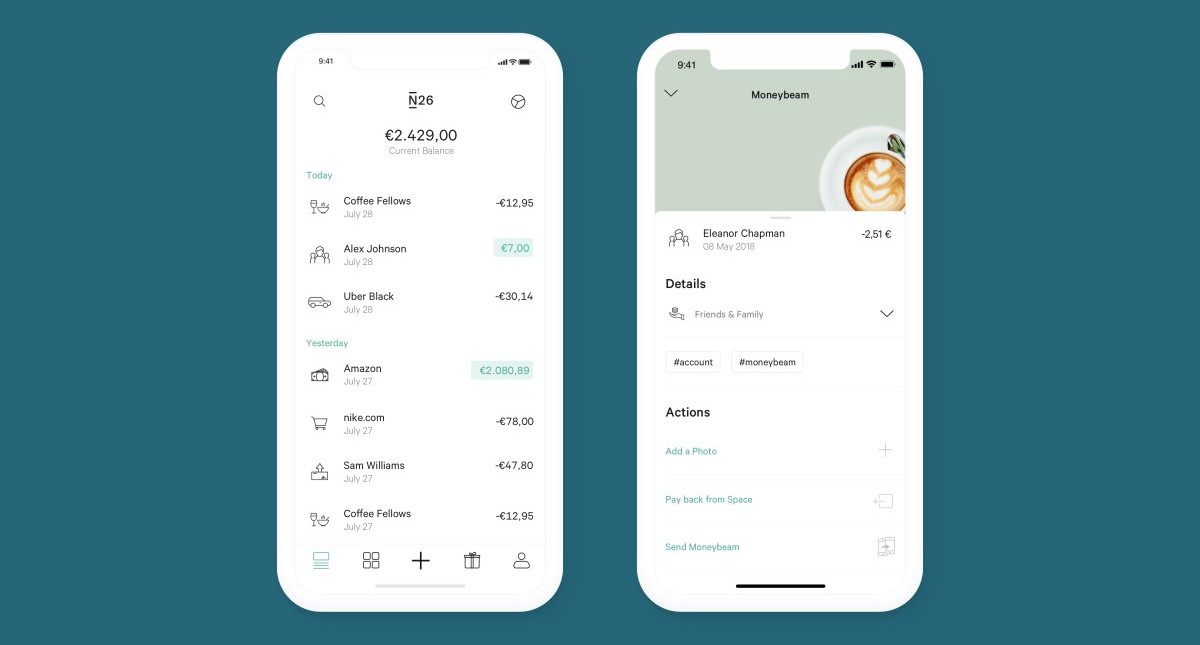

Base Salary Explained A Guide To Understand Your Pay Packet N26

Salary Calculator Difference Between Gross Salary And Net Salary

Salary Structure Components How To Calculate Take Home Salary

Understanding The Contents Of A French Pay Slip Fredpayroll

Gross Salary Definition Importance Example Human Resources Hr Dictionary Mba Skool Study Learn Share

Base Salary Explained A Guide To Understand Your Pay Packet N26

Understanding The Contents Of A French Pay Slip Fredpayroll

Base Salary Explained A Guide To Understand Your Pay Packet N26

Country Spotlight What To Know About Payroll In France

How To Calculate Bonuses For Employees

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

Post a Comment for "Gross Salary Include Bonus"