Ytd Gross Salary Meaning

For a business year-to-date represents the earnings all employees. Net Pay Details Net Pay take-home pay.

Payslip In Spain How Does It Work Blog Parakar

It includes only payments actually made to or on behalf of the employee.

Ytd gross salary meaning. What is total net pay. It includes whatever base salary an employee receives along with other types of payment that accrue during the course of their work which. Year to date column shows total Gross Salary total deductions total tax deucted and net income based on a calendar year.

Taxable Pay Taxable pay is Gross Pay minus any tax-free elements eg. This is the total amount of pay in the fiscal year that is subject to federal taxation. Den at d end theres a grand.

Ytd is d total amour u v been paid frm January till date. YTD income for businesses is referred to as net income and is reduced by business expenses. YTD is calculated as a straight sum of similar line items on each paystub from the beginning of the year.

TD OR YTD This means To Date or Year To Date. Taxable Income Taxable Income Taxable income refers to any individuals or business compensation that is used to determine tax liability. This is different than what it means for a business where year-to-date represents the overall earnings all employees earned.

STILL CONFUSED OR WANT TO CHECK ANOTHER TERM NOT LISTED HERE. It also includes payments paid in this current fiscal or calendar year but not necessarily received this year. Gross income is the amount an employee earns before taxes and deductions are taken out.

For full-time employees YTD payroll represents their gross income. Year-to-date earnings are the gross earnings for an employee for the period from the beginning of the year through the date of the report or payroll record. Taxable Pay Taxable pay is Gross Pay minus any tax-free elements eg.

Most banks and lenders will use a Year to Date calculator to work out the income figure to use on your home loan application and in a lot of cases the banks will use the lower figure of your YTD income and your group certificate. Gross income includes all income you receive that isnt explicitly exempt from taxation under the Internal Revenue Code IRC. What is Year to Date YTD in payroll.

Your net pay is what you actually receive into your bank account once all the deductions have been taken off. Year-to-date -- or YTD for short -- income represents the income youve received so far this year. Year to date YTD is cumulative earnings accrued from the beginning of the year January 1st to the current date of the payroll.

YTD income for businesses and YTD income for individuals are calculated differently. YTD Deductions - this is the amount that was deducted from a persons YTD Gross for taxes 401k plan health savings account commuter benefits and other factors. Your gross pay is what youve earned before any deductions have been taken off.

What does YTD stand for in Logistics. For a company gross income equates to gross margin which is sales minus the cost of goods soldThus gross. This is the difference between total Pay and Allowance minus total of Deductions.

In other words Year to Date YTD income represents what you should earn over the course of 12 months. Simply stated your YTD short for Year-to-Date amount shows the sum of your earnings from the beginning of the current calendar year to the present time or the time your pay stub was issued. Lenders use the year to date calculation to determine annualized monthly income.

What is total gross pay. What is the meaning of year-to-date YTD in a salary slip. There are several practical uses for understanding your YTD amounts.

YTD stands for Year to Date. Taxable income is the portion of your gross income thats actually. The total income amount or gross income is used as the basis to calculate how much the individual or organization owes the.

YTD Gross - this is the amount a person earned for the year before deductions. Earnings are defined in IRS 1040 instructionsfor items included on line 7 pages 19-20 and in the IRS general. As well as showing earnings and deductions for that specific pay period your payslip should also show you a combined total for that tax year to date.

The paystubs keep track of various YTDs like regular earnings withholdings and other deductions along with gross pay. YTD Net Pay - this is the amount a person earned for the year after deductions. If you work more than one job youll have a gross salary amount for each one.

Creditors often look at your gross salary when determining whether or not they should extend you credit and if. For employees year-to-date payroll is their gross income. For instance if ur hazard allowance is 5k monthly den after ur august salary ur year till date earning as far as ur hazard alowance goes is 40k which is total amount frm January till date august it is calculated for ur basic salary and oda allowances.

Gross salary is the term used to describe all of the money youve made while working at your job figured before any deductions are taken for state and federal taxes Social Security and health insurance. In this article well take a closer look. Total Deductions Details total of all Deductions 19.

This amount could consist of a sales commission sale made at the end of last year but not paid out until this year. YTD personal income on the other hand includes income from all sources and isnt reduced by expenses. YTD can also include the money paid to your independent contractors.

Independent contractors are not your employeesthey are self-employed people hired for a specific job. Your final paycheck of the year will have almost the same information as on your T4 slip.

Simple Income Statement Template Lovely 11 In E Statement Examples Sample Example Format Income Statement Statement Template Financial Statement

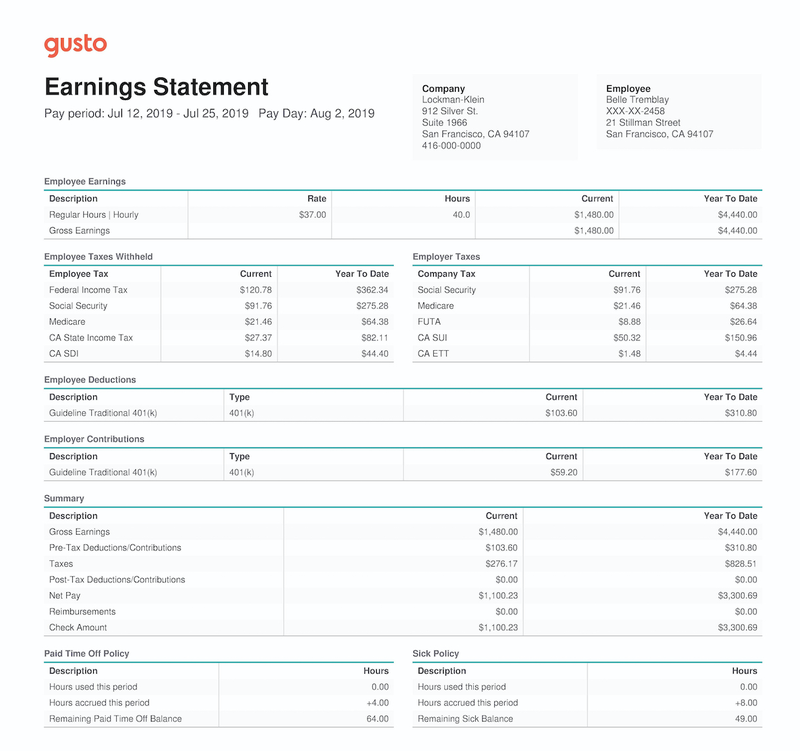

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Understanding The Contents Of A French Pay Slip Fredpayroll

Payslip In France How Does It Work Blog Parakar

Employer How Does Salary Sacrifice And The Cycle To Work Scheme Work For Employers Cyclescheme Knowledge Base

Ytd Calculator And What Is Year To Date Income Calculator

Understanding The Contents Of A French Pay Slip Fredpayroll

Payslip In Spain How Does It Work Blog Parakar

Https Pssc Gov Ie Wp Content Uploads Payslip Explained Extended Version 161019 Pdf

Gross Wages What Is It And How Do You Calculate It The Blueprint

Hrpaych Yeartodate Payroll Services Washington State University

We Make A Personalized High Quality Paycheck Stub W Company Logo For You Including Income Taxes Deductions Ytd Totals Credit Card App Paycheck Dr Note

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Payslip In France How Does It Work Blog Parakar

Payslip In France How Does It Work Blog Parakar

The Complete Guide To Bookkeeping For Small Business Owners Small Business Finance Small Business Organization Bookkeeping Business

A Guide On How To Read Your Pay Stub Accupay Systems

/dotdash_Final_How_Do_Gross_Profit_and_Gross_Margin_Differ_Sep_2020-01-441a7bebdebb492a8ac3a1e3ea890ab9.jpg)

How Do Gross Profit And Gross Margin Differ

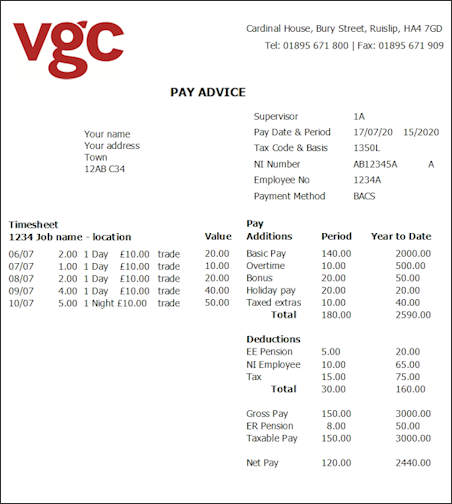

How To Read Your Payslip Vgc Group

Post a Comment for "Ytd Gross Salary Meaning"