Wage Calculator Idaho

After a few seconds you will be provided with a full breakdown of the tax you are paying. The maximum amount that can be garnished from your weekly paycheck is 125 since the lesser amount.

Quaid E Azam University Of Pakistan University Candidate Art Masters

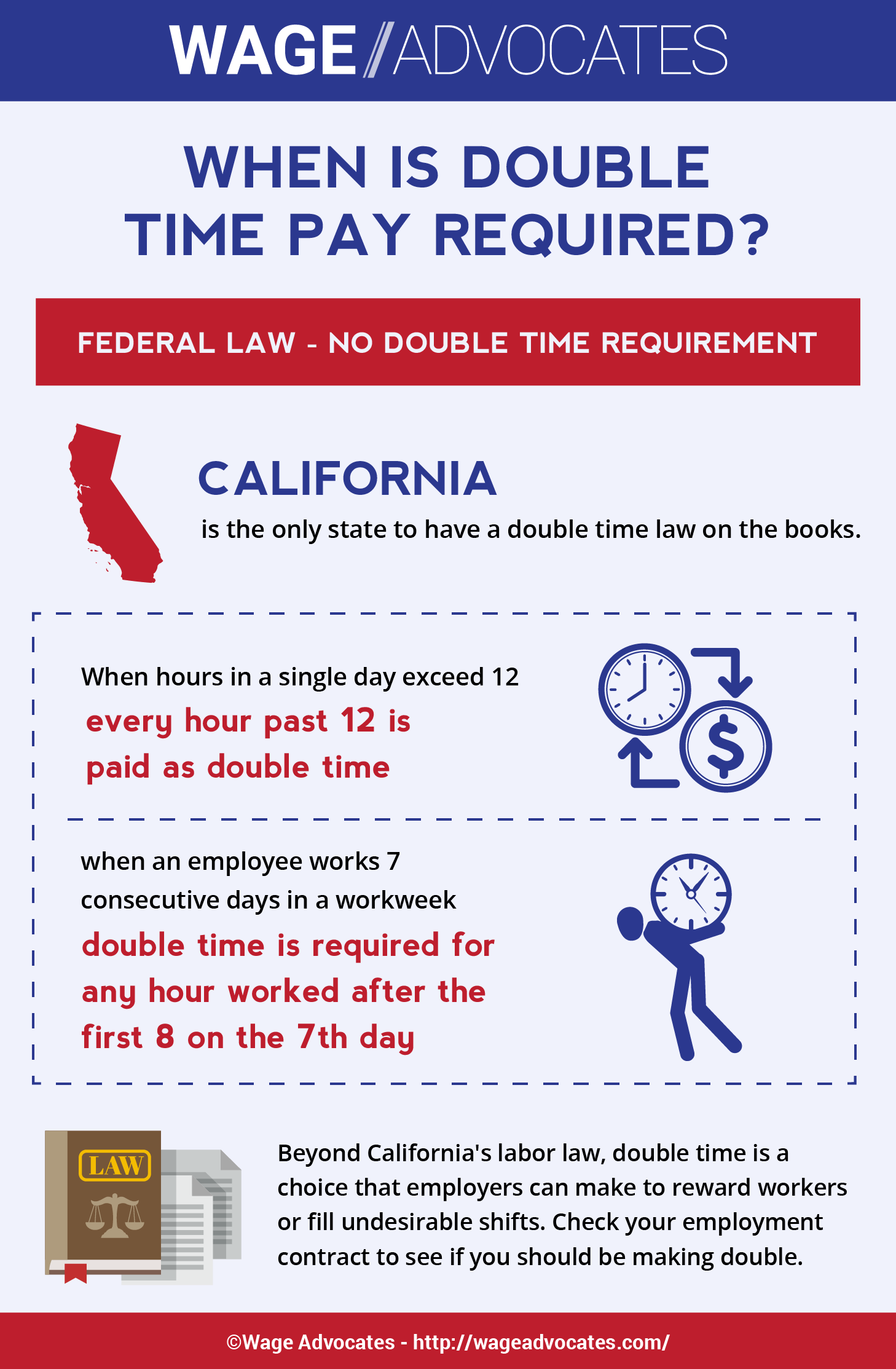

In addition to the federal wage there are rates set in other states.

Wage calculator idaho. Welcome to the Idaho Wage Calculator. As of Jul 5 2021 the average annual pay for the Average jobs category in Idaho is 58479 an year. The federal minimum wage is 725 per hour and the Idaho state minimum wage is 725 per hour.

WHAT IS THE LIVING WAGE CALCULATOR. There are legal minimum wages set by the federal government and the state government of Idaho. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs.

The pay may be in cash or in another form. The results are broken up into three sections. The living wage shown is the hourly rate that an.

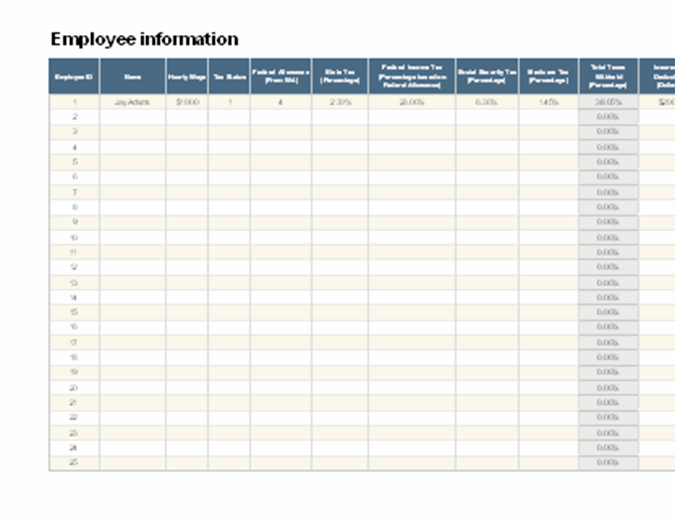

45 of the United States have their own state-wide minimum wage legislation. This calculator can determine overtime wages as well as calculate the total earnings for tipped employees. Paycheck Results is your gross pay and specific deductions from your paycheck Net Pay is your take-home pay and Calculation Based On is the information entered into the calculator.

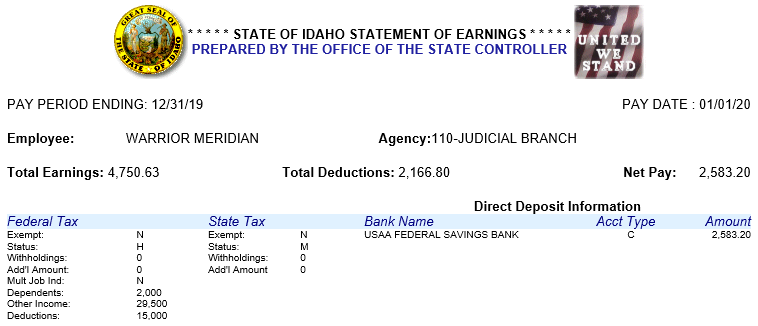

The living wage shown is the hourly rate that an individual in a household must earn to support his or herself and their family. The Net Pay Calculator is used by State of Idaho employees to estimate the impact of a change to pay rate hours worked deductions withholdings andor taxes may have on their take home pay. The Idaho Minimum Wage is the lowermost hourly rate that any employee in Idaho can expect by law.

You can use this calculator to determine your pre-tax earnings at an hourly wage-earning job in Idaho. The law states that whichever is the higher applies. The living wage shown is the hourly rate.

While ZipRecruiter is seeing salaries as high as 125000 and as low as 18842 the majority. These occupational employment and wage estimates are calculated with data collected from employers in all industry sectors in metropolitan and nonmetropolitan areas in Idaho. The employees current payroll information is presented on the form as a starting point.

This is the equivalent of 1125week or 4873month. The amount by which your disposable earnings exceed 30 times 725 is 28250 500 30 725 28250. Living Wage Calculation for Kootenai County Idaho.

All wages tips and other compensation that employees earned or were paid for services performed in Idaho are subject to Idaho income tax withholding. 23 lignes Living Wage Calculation for Idaho. Generally if the Idaho compensation is subject to federal income tax its also subject to Idaho.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Just in case you need a simple salary calculator that works out to be approximately 2811 an hour. The living wage shown is the hourly rate that.

In order to determine an accurate amount on how much tax you pay be sure to. Use this figure and the annual tables to compute the amount of withholding required. The federal minimum hourly wage is currently 725 an hour.

Additional information including the hourly and annual 10th 25th 75th and 90th percentile wages and the employment percent relative standard error is available in the downloadable XLS file. Pay includes salaries vacation allowances bonuses commissions and fringe benefits. All you need to do is enter wage and W-4 information for each employee and our payroll tax calculator will calculate all the Idaho and Federal payroll taxes for you.

This Idaho hourly paycheck calculator is perfect for those. The tool helps individuals communities and employers determine a local wage rate that allows residents to. Families and individuals working in low-wage jobs make insufficient income to meet minimum standards given the local cost of living.

Use our calculator to discover the Idaho Minimum Wage. Idaho Hourly Paycheck Calculator Results Below are your Idaho salary paycheck results. Whichever is the higher of the state minimum wage and the federal minimum wage is the one that.

Subtract the Idaho Child Tax Credit allowances from the gross wages to determine the amount subject to withholding. These are set by the governing bodies of each state and they deal with setting the rates and decreeing the laws around minimum wage in their boundary. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

Overview of Idaho Taxes Idaho has seven income tax brackets ranging from 1125 to 6925. To use our Idaho Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. The tool provides information for individuals and households with one or.

We developed a living wage calculator to estimate the cost of living in your community or region based on typical expenses. If you make 500 per week after all taxes and allowable deductions 25 of your disposable earnings is 125 500 25 125. Idaho Hourly Paycheck Calculator.

Federal Payroll Taxes First and foremost we have to take care of Uncle Sam. The assumption is the sole provider is working full-time 2080 hours per year. 23 lignes Living Wage Calculation for Idaho Falls ID.

23 lignes Living Wage Calculation for Ada County Idaho. It doesnt matter how you measure the compensation or make the payment. Annualized Wage method Multiply the wages for the pay period by the number of pay periods in the calendar year.

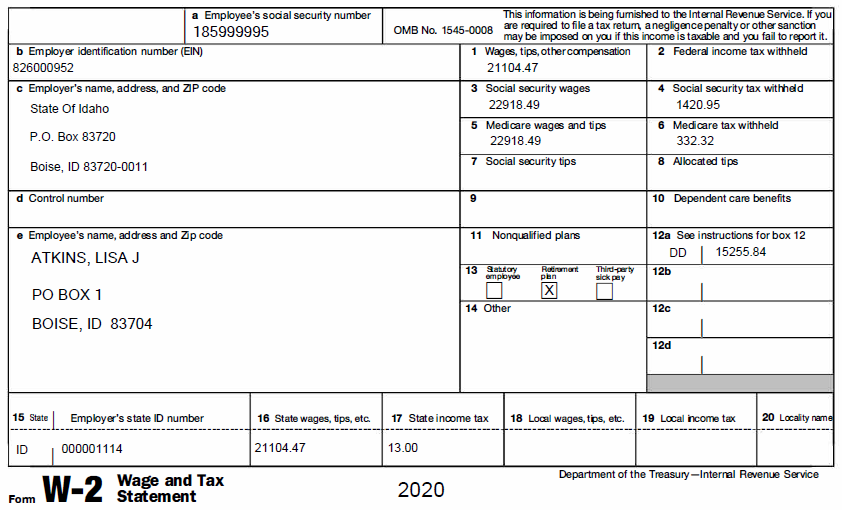

Reading Your W 2 Wage And Tax Statement

Social Security Benefit Calculation Spreadsheet Social Security Social Security Benefits Social

Opinion What Happens When Women Stop Leading Like Men Published 2019 Christchurch Women In Leadership Woman Face

Washington Paycheck Calculator Smartasset

Opinion America Made Me A Feminist Published 2017 Feminist America The New York Times

How To Calculate Overtime Pay Easy Overtime Calculator A Basic Guide

Reading Your W 2 Wage And Tax Statement

7 Unrecyclable Items That Really Can Be Recycled Plastic Shopping Bags Plastic Grocery Bags Plastic Bag

What S The Difference Between Minimum Wage Prevailing Wage And Living Wage Govdocs

What Is Double Time Pay When Is It Mandatory Overtime Lawsuit

The Living Wage Map Story Map Map Classroom Images

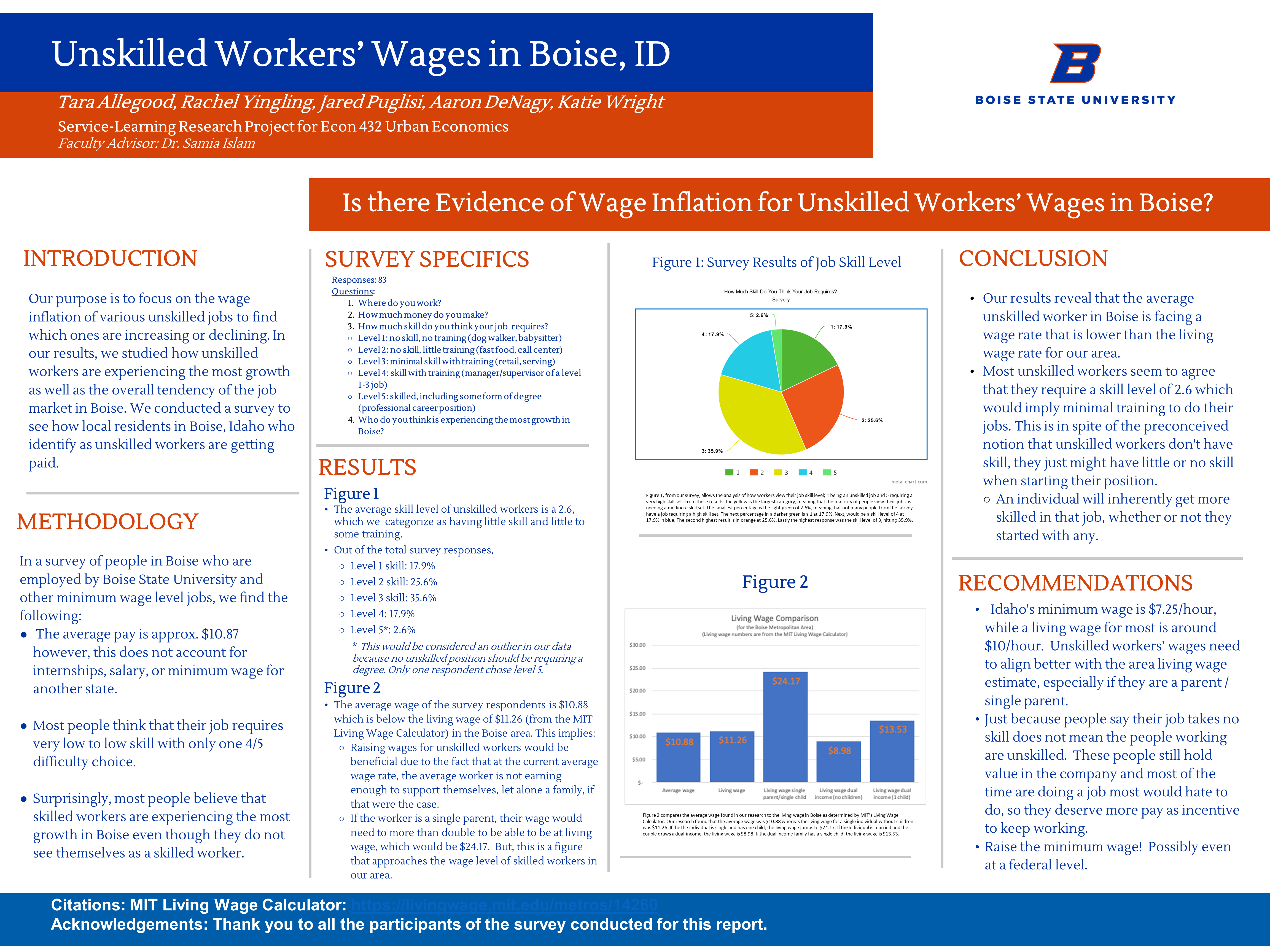

244 Unskilled Workers Wages In Boise Id Undergraduate Research

If You Re In The Process Of Buying A Home These Tips Will Help You Along The Way Dre 02066701 Home Buying Florida Real Estate Real Estate Information

These Are The States With The Lowest Costs Of Living Cost Of Living Retirement Locations Financial Literacy Lessons

Post a Comment for "Wage Calculator Idaho"