Wage Subsidy Calculator Nz

The Wage Subsidy March 2021 was available from 1pm on 4 March 2021 to 1159pm on 21 March 2021. If you are being paid at 80 this calculator helps you work out the correct pay.

Number Of People On Jobseeker Support Increases By 20 In A Month Only 0 17 Of Wage Subsidy Payments Found To Have Ended Up In The Wrong Hands Interest Co Nz

If you are an employee and being paid the wage subsidy as a lump-sum by your employer instead of weekly payments there may be some tax implications.

/cloudfront-ap-southeast-2.images.arcpublishing.com/nzme/4CIC5KSB6UH55H4JTFGTCZYQWY.jpg)

Wage subsidy calculator nz. Enter your revenue and employee pay information into the calculator. Calculate your take home pay from hourly wage or salary. Mark applies for and receives a wage subsidy of 1825920 from MSD for himself Joe and Mary.

Management of the Wage Subsidy Scheme. Visit the Employment NZ COVID-19 website for information about employment law and the wage subsidy. Wage and salary earners paid a lump-sum.

Calculate your amount. We expected you would pay them normal wage and then probably have to repay the govt the excess. Although the lump-sum payment makes up 12 weeks-worth of payments for tax purposes this treated as earned when you receive it.

58580 for people working 20 hours or more per week. This makes a difference if you were paid the lump-sum payment on or before 31. This was paid to him on 28 March 2020.

We have other supports for employers. Revenue calculator Wage Subsidy Extension. Wage Subsidy Calculator and Cash Flow Forecaster This calculator helps you clearly understand the COVID-19 wage subsidies and is critical to gaining insight into.

Consequently when the wage subsidy. Under the scheme employers contractors sole traders self-employed people registered charities and incorporated societies can receive a subsidy to help pay wages if they can show a 30 decline or expected decline in revenue for any month between January and June 2020 compared to the same month in 2019. This means that the grant should be recognised as the wage and salary costs that are being subsidised are recognised with recognition not to occur prior to the entity receiving confirmation of the amount of wage subsidy that it will receive.

You can click here for more info on the wage subsidy. If you receive any wage subsidy its important that you submit to Inland Revenue. The Wage Subsidy March 2021 is paid as a 2-week lump sum at the rate of.

If you are unsure what your pay and hours situation is you can use this questionnaire to figure it out. If you are unsure of the numbers talk to your bank accountant or business advisor. Worksheet to forecast and track requirements for the COVID-19 Wage Subsidy.

The purpose of the New Zealand Government wage subsidy is to assist a business to meet wage costs over a specific calendar period. Information about the number and value of repayments made to the Wage Subsidy Scheme as at 5 March 2021 was supplied to us by the Ministry of Social Development at the time of our audit. Resurgence calculator Resurgence Wage Subsidy.

Use the online calculator or downloadable spreadsheet before you apply to find the amount of CEWS or CRHP you can claim. Read the whole report 60 pages in HTML. The date your 14-day subsidy period begun depended on the date you applied.

This can be kept as a record for audit purposes. Some puzzling guidance has come out of WINZ today which states that if the employees normal wage is below the subsidy amount you still pay them the full subsidy. This is a simplified approach to help you calculate and document your revenue to find out if you were eligible for the wage subsidy extension.

Easy information about the subsidy in laymans terms HERE. All numbers are gross before tax not net after tax and other deductions like student loans kiwisaver etc pay. HOW TO CALCULATE YOUR EMPLOYEES WAGES Determine your employees usual weekly wages Hourly rate x hours worked or weekly salary rate.

The Wage Subsidy is paid as a lump sum to employers and covers 12 weeks payment per employee at the flat rate of. The Ministry has since reported different information about the amount of voluntary repayments made by that date. Calculate to see whether the CEWS or CRHP amount is higher so you will know which subsidy to apply for.

KiwiSaver Student Loan Secondary Tax Tax Code ACC PAYE. The Wage Subsidy March 2021 was to help employers and self-employed people keep paying staff and protect jobs impacted by the alert level changes on 28 February 2021. This means you can have situations where a part time employee normally does 4 hours work in a week and will get 350 where.

Please contact us at infocorehrconz or 09 376 1643 if you need any assistance. New Zealands Best PAYE Calculator. Marks employees Mary and Joe 702960 of the wage subsidy should be passed on to Joe and 4200 to Mary over the 12 weeks following the wage subsidy receipt.

The total amount in respect of all employees is paid out in a lump sum that covers a 12-week period. To help workers who have seen their pay cut to 80 and whose employer has applied for the wage subsidy Unite Union has developed an online calculator at. 58580 a week for each full-time employee retained 20 hours a week or more 350 a week for each part-time employee retained less than 20 hours a week.

To have received the Wage Subsidy Extension you must have experienced a 40 decline in revenue over a 30-day consecutive period in the 40 days before the date of application from 10 May 2020. You may want to use our simplified spreadsheets to document your revenue if you have applied for the Wage Subsidy Extension or Resurgence Wage Subsidy. 35000 for people working less than 20 hours per week.

The Wage Subsidy allows qualifying organisations to claim NZ702960 for a full-time employee and NZ4200 for a part-time employee working less than 20 hours per week.

Covid 19 Wage Subsidy Payments Myob Essentials Accounting Myob Help Centre

What S New Update Covid 19 Wage Subsidy Extension Dyhrberg Drayton Employment Law

Lewis Silkin International Approaches To Covid 19 Job Retention And Wage Subsidy Schemes

All You Need To Know About The New Zealand Wage Subsidies Nztax Com Au

Is My Subsidised Pay Correct Unite Union Releases Wage Subsidy Calculator Unite Union

Is Your Business Eligible For Covid 19 Wage Subsidy Extension The Smart And Lazy

How To Calculate Company Tax Nz

Budget 2020 Sees Another 16 Billion Allocated Towards Covid Relief Packages Including An Extended Wage Subsidy Treasury Forecasts A 28 Billion Budget Deficit In 2020 And A 60 Billion Bond Issuance Programme For 2021 Interest Co Nz

Auckland To Remain At L3 The Rest Of The Country To Remain At L2 Until August 26 Decision To Be Reviewed On August 21 Wage Subsidy Extended Nationwide While L3 Restrictions Remain

Unite Union A Handy Flowchart To Help Indicate What You Facebook

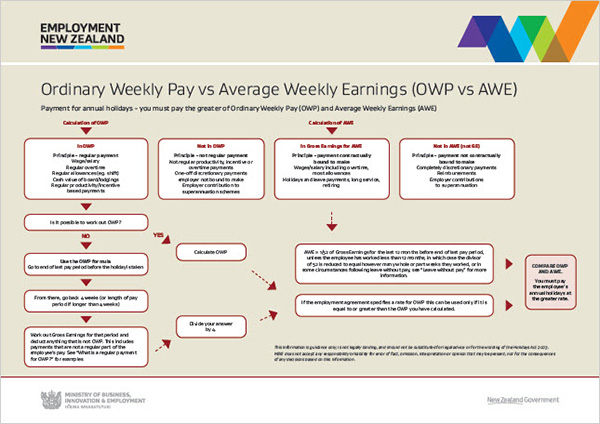

Calculating Annual Holiday Payment Rates Employment New Zealand

Covid 19 Wage Subsidy Payments Ace Payroll Myob Help Centre

Wage Subsidy Worksheet Core Hr

Covid 19 Breakdown Of Government Relief Package Rsm New Zealand

/cloudfront-ap-southeast-2.images.arcpublishing.com/nzme/4CIC5KSB6UH55H4JTFGTCZYQWY.jpg)

Covid 19 Coronavirus Resurgence Wage Subsidy Scheme Pays Out 33 Million In First Week Nz Herald

Covid 19 Wage Subsidy Payments Support Notes Myob Payroll New Zealand Myob Help Centre

Covid 19 The Latest Wage Subsidy Information

Covid 19 Business Support Cooperaitken Chartered Accountants Waikato

Covid 19 Concessions For 189 New Zealand Stream Visa Australian Migration Agents And Immigration Lawyers Melbourne Visaenvoy

Post a Comment for "Wage Subsidy Calculator Nz"