Salary Calculator Qld

Its the tool our Infoline advisers use to answer your enquiries. And you can figure out are you eligible for and how much of Low Income Tax Offset you.

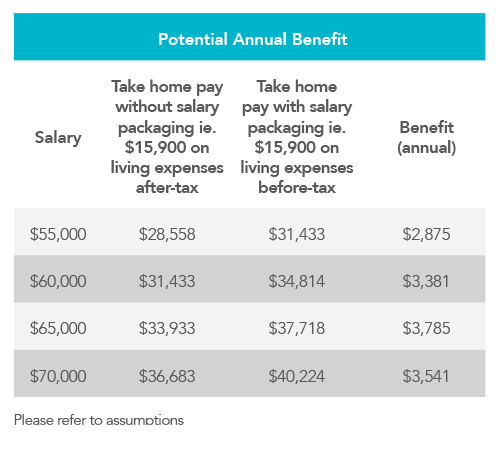

To find out more about salary packaging click here.

Salary calculator qld. For employees making the 2 Standard Contribution rate the calculators default employer rate is based on the trust deed which remains at 975. Differences will always be favour of the ATO however these will be refunded when the annual year tax return is processed. If you are interested in salary packaging talk to your employer or ask your HR team to contact us on 1300 218 598.

Pay calculator QLD - most popular salary calculations in Queensland and Brisbane last year. This Australian Salary Calculator will show you what your weekly fortnightly monthly Income or Net Salary will be after PAYG tax deductions. You can then see how your salary.

How to use this Pay Calculator. You can use the calculator on this page as a PAYG calculator to determine the amount of tax you will need to pay as a business owner and plan your PAYG instalments to the ATO. It does not offer a complete overview of applicable taxation methods.

Calculate your liability for periodic annual and final returns and any unpaid tax interest UTI. Many Queensland Government employees are required to make Standard Contributions of between 2 and 5 of their fortnightly superannuable salary. This calculator does not use or consider any individuals own financial circumstances at all.

In most cases your salary will be provided by your employer on an annual basis. The Queensland Government has announced changes to payroll tax rates and thresholds from 1 July 2019. Anything you earn above 180001 is taxed at 45.

The ATO publish tables and formulas to calculate weekly fortnightly and monthly PAYG income tax instalments that can vary from the annual tax amounts. Learn your salary taxes and superannuation contributions. To help you find the information you need wed like to know if you are an employee or an employer.

Use this calculator to quickly estimate how much tax you will need to pay on your income. Salary packaging is only available to eligible employees of the Queensland Government as per the Standing Offer Arrangement PTD0027-16. Leasing PBI cards.

Choose if thats annual monthly fortnightly or weekly amount. The information in this publication has been prepared by. It can be used for the 201314 to 202021 income.

Casual teachers in Queensland state schools are paid approximately 76 per hour. The Pay Calculator calculates base pay rates allowances and penalty rates including overtime. Youll then pay 19 on earnings between 18201 and 45000 325 on earnings between 45001 and 120000 and 37 on earnings between 120001 and 180000.

What are the most common pay calculations in QLD. Salaries are based on the current awards and agreements for public sector employees. Gross pay Tax on this pay Medicare levy Net pay annually Net.

The reason is to make tax calculations simpler to apply but it can lead to discrepancies. The Salary Calculator will also calculate what your Employers Superannuation Contribution will be. This calculator provides general information only by using some generic taxation scenarios and some publicly available general material published on the ATOs website.

Simple tax calculator This link opens in a new window it will take between 2 and 10 minutes to use this calculator. About Brisbane Queensland. If you have HELPHECS debt you can calculate debt repayments.

You can use our calculators to determine how much payroll tax you need to pay. See how much youll be paid weekly fortnightly or monthly with our easy to use pay calculator. This calculator is always up to date and conforms to official Australian Tax Office rates and formulas.

For a permanent or temporary beginning teacher with a four-year degree the base salary in Queensland state schools is approximately 70000 per year. Whats your take home pay. Brisbane influenced data the most obviously but heres the most popular pay calculations in Queensland last year.

You can still use our handy salary packaging calculator to see how much you could save. This calculator helps you to calculate the tax you owe on your taxable income. The average salary in Brisbane Queensland is AU69k.

The implications of salary packaging for you including tax savings and impacts on benefits surcharges levies andor other entitlements will depend on your individual circumstances. The Medicare levy in this calculator is based on individual rates and does not take into account family income or dependent children. The calculations do not include the Medicare Levy Surcharge 1-15 an additional levy on individuals and families with higher incomes who.

If you are using the Pay Calculator as a Salary Calculator simply enter your annual salary and select the relevant options to your income. The calculator only allows for employer contribution rates between 95 and 20. Select other options if that applies to you.

Trends in wages decreased by -1000 percent in Q1 2021.

Setting Your Hourly Rate Professional Contractors And Consultants Australia

Setting Your Hourly Rate Professional Contractors And Consultants Australia

Qld Govt Forced To Defend Another Payroll Project Software Itnews

Payroll Tax Deductions Business Queensland

Free Timesheet Calculator For Payroll Roster Calculator Tanda

Aca Salary Calculator Aca Association Of Consulting Architects Australia

Payroll Tax Deductions Business Queensland

Salary Packaging Walshs Practice And Walshs Financial Planning

Payroll Tax Deductions Business Queensland

What Is Annual Income How To Calculate Your Salary Salary Calculator Income Tax Return Income

Salary Sacrifice Calculator Qsuper

Salary Calculator Salary Calculator Calculator Design Calculator

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Salary Calculator

Employees Daily And Monthly Salary Calculation With Overtime In Excel By Learning Centers Excel Tutorials Salary

Salary Packaging Calculator Remserv

Could A Help Hecs Debt Impact My Salary Packaging Remserv

Post a Comment for "Salary Calculator Qld"