Gross Salary Definition

The value of the total remuneration package for each group of local staff with tasks comparable to those of local staff. Gross salary can be defined as the amount of money paid to an employee before taxes and deductions are discounted.

Gross Salary Simplified Definition Components Calculation Razorpayx Payroll

Sutilise avec les articles le l devant une voyelle ou un h muet un.

Gross salary definition. Gross income represents wages received which includes the employees base salary and additional earnings and financial bonuses. Wages and salaries are the payment for work agreed between an employee and his or her employer under the contract of employment in the private sector and for contractual agents in the public service or employment for civil servants. Gross salary includes bonus overtime pay allowances and other perks.

Corresponding to the net base salaries gross base salary minu s staff assessment at current grades or groups of grades. It includes the basic salary or index-linked salary in the civil service but also bonuses and allowances. Gross salary is the term used to describe all of the money youve made while working at your job figured before any deductions are taken for state and federal taxes Social Security and health.

This amount is equal to your base salary plus all benefits and allowances such as special allowances overtime pay medical insurance travel allowance and housing allowance. And other monetary payments contributions. Pay before tax salaire brut nm.

Here a basic salary is the base income of an employee or the fixed part of ones compensation package. Gross salary is the monthly or annual salary paid to an employee without any tax deductions. Gross salary refers to the full payment an employee receives before tax deductions and mandatory contributions are removed.

Gross salary is the total amount of money that is given to an employee as salary or wages before any taxes or deductions are cut from their paycheck. Meanwhile net income is the amount left over taxes and health insurance. La moitié de la salarié sélève généralement autour de 10 de leur salaire brut.

Ce montant est déterminé à lintérieur dune. 20000 as a fixed salary. Don dune somme dargent frClasse wage.

Gross pay is the total amount of money an employee receives before taxes and deductions are taken out. 20 000 then heshe will get a Rs. Gross salary is calculated by adding an employees basic salary and allowances prior to making deductions including taxes.

Refers to person place thing quality etc. Months of gross salary less staff assessment where applicable. Employed in the Delegation will be.

Reimbursement of special expenses incurred in the course of employment. An employee has a gross salary of Rs. For example when an employer pays you an annual salary of 50000 per year this means you have earned 50000 in gross pay.

Common allowances on your payslip. It refers to the annual sum or monthly sum that an employee earns in the course of his job position. Un oubli important.

Tranche ou dun groupe. Basic salary is the salary paid to an employee before the addition of any benefits like allowances or perquisites. Garçon - nm On dira le garçon ou un garçon.

A salary is the money that someone is paid each month by their employer especially when. 50 000 and basic salary of Rs. Gross Salary is the amount of salary after adding all benefits and allowances but before deducting any tax For Example.

But theres a significant difference between the two. It includes payments paid under employee savings schemes profit-sharing and incentive schemes. Base pay and gross pay may seem to describe the same or similar things.

Calculated by ad ding gross salary leve ls allowances. Gross rate of pay includes allowances that an employee is entitled to under a contract of service What is excluded Gross rate of pay excludes. The gross salary corresponds to the total payments received by the employee under his employment contract prior to any deduction of compulsory employee contributions.

Overtime payments bonus payments and annual wage supplements AWS. The employees half usually totals around 10 of their gross salary. It is the gross monthly or annual sum earned by the employee.

Mois de traitement brut déduction faite selon quil convient de la contribution du personnel. Meaning pronunciation translations and examples.

Gross Vs Net Income Importance Differences And More Bookkeeping Business Accounting And Finance Finance Investing

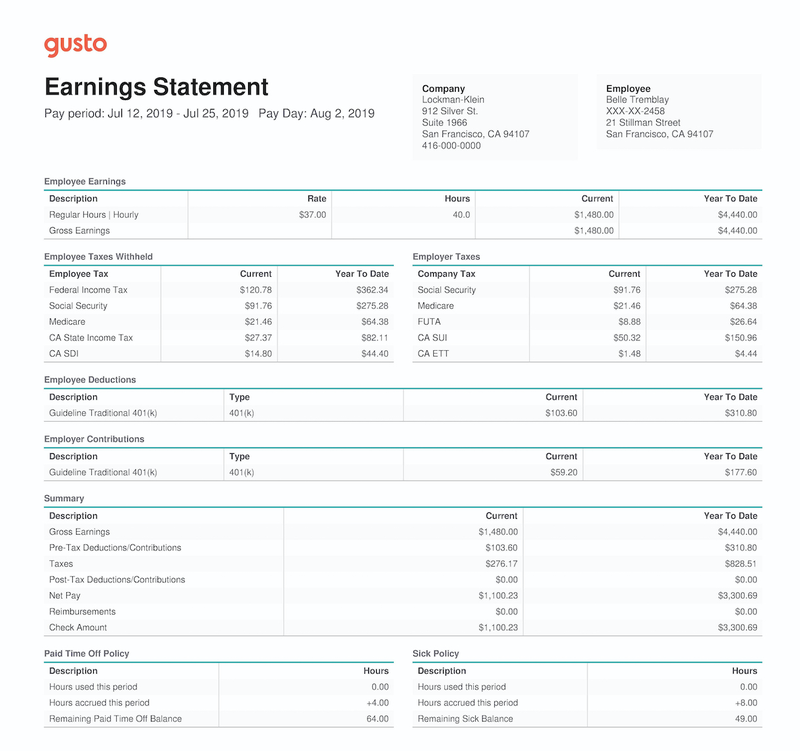

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

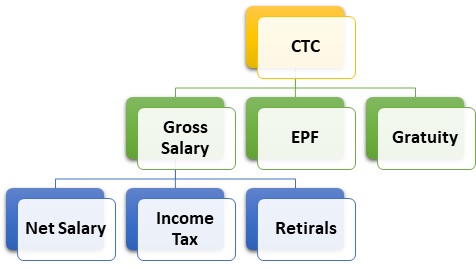

Salary Net Salary Gross Salary Cost To Company What Is The Difference

What Is Gross Income For A Business

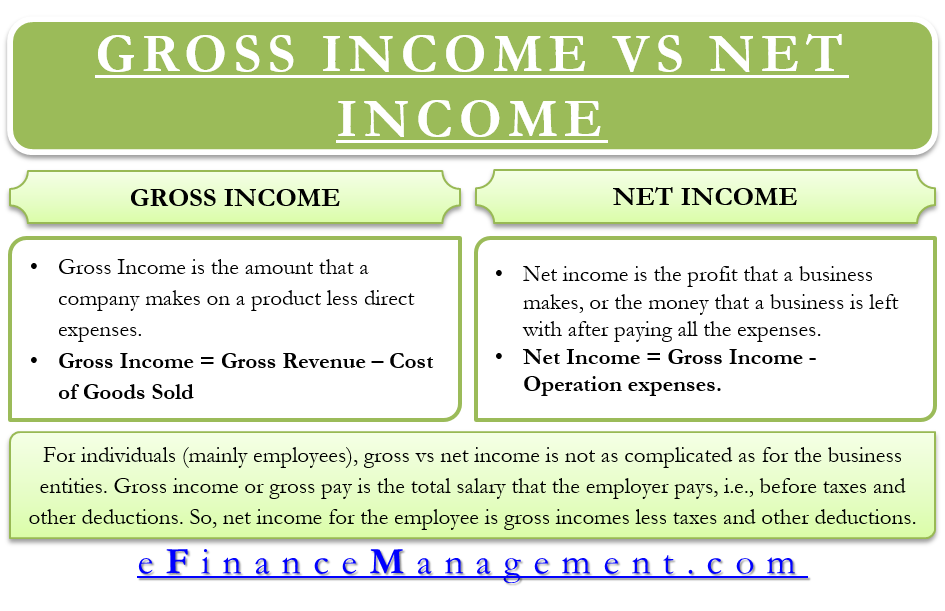

Gross Salary Vs Net Salary Top 6 Differences With Infographics

Gross Salary Definition Importance Example Human Resources Hr Dictionary Mba Skool Study Learn Share

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

Salary Net Salary Gross Salary Cost To Company What Is The Difference

The Difference Between Gross And Net Pay Economics Help

Gross Salary Definition Importance Example Human Resources Hr Dictionary Mba Skool Study Learn Share

Gross Wages What Is It And How Do You Calculate It The Blueprint

What Is Base Salary Definition And Ways To Determine It Snov Io

What Are Gross Wages Definition And Overview

Difference Between Gross Income Vs Net Income Definitions Importance

Understanding The Contents Of A French Pay Slip Fredpayroll

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Computation Of Gross Salary Income

:max_bytes(150000):strip_icc()/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Post a Comment for "Gross Salary Definition"