Gross Salary Calculator Uk

You will see the costs to you as an employer including tax NI and pension contributions. 45000 Salary Calculations example If your salary is 45000 a year youll take home 2853 every month.

Get Salary Smart New Salary Calculator Career Blog

GROSS INCOME - Enter the gross income you receive from your employment.

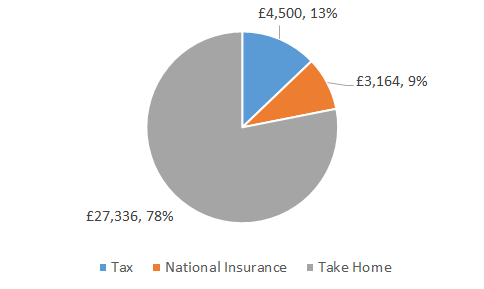

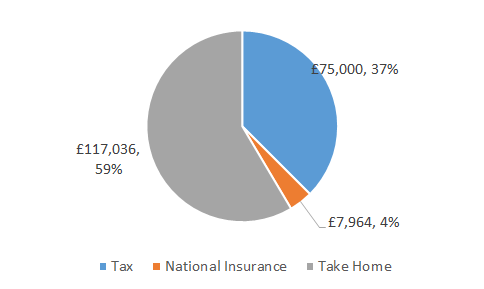

Gross salary calculator uk. Please note where a net salary has been agreed the employer will be covering the employees pension contribution in addition to their own. Youll pay 6500 in tax 4260 in National Insurance and your yearly take-home will be 34240. Dividend Salary Calculator Results.

SalaryBot will automatically check to see if youre being paid the minimum wage for your age group. Estimating the average household budget in the UK expenditure is around 500 per week. Select the time for which you are paid.

But an employee owes HMRC a chunk of their salary for both income tax and national insurance contributions. To accurately calculate your salary after tax enter your gross wage your salary before any tax or deductions are applied and select any conditions which may apply to yourself. Gross salary is the total salary an employer has contractually agreed to pay an employee.

Gross Income Per Year Month Week Day. Use the calculator to work out an approximate gross wage from what your employee wants to take home. The deductions used in the calculator assume you are not married and have no dependants.

You can use the net salary after tax figures to work out how much your take-home salary is after all tax and National Insurance contributions have been deducted. Use SalaryBots salary calculator to work out tax deductions and allowances on your wage. All calculations will be based on an full years income at the rate specified.

If you are based outside the UK you should contact the Direct Tax Team for more information on your take home pay as you may be subject to overseas tax regulations. The sum of all taxes and contributions that will be deducted from your gross salary. How to use the Take-Home Calculator.

Net Salary Calculator 2020 10855 KB Excel Please note. If you specify you are earning 2000 per mth the calculator will provide a breakdown of earnings based on a full years salary. If you have a salary sacrifice please enter the amount after sacrifice unless the sacrifice is for childcare vouchers or pension and they have been detailed in the calculator.

21 lignes The 20202021 Net Salary Calculator below outlines the net salary amount for each possible. Net salary is calculated when income tax and national insurance contributions have been deducted from the. Calculations for tax are based on a tax code of S1250L.

You may pay less if tax credits or other deductions apply. Use the calculator to work out what your employee will take home from a gross wage agreement. Hourly rates weekly pay and bonuses are also catered for.

If self employed or CIS enter the profit figure. Our simple salary calculator gives an estimate of your take-home pay after your employer has made deductions from your gross salary. These include income tax as well as National Insurance payments.

The results are broken down into yearly monthly weekly daily and hourly wages. For someone under the age of 30 this would require a salary of over 31000 per year. Enter the number of hours and the rate at which you will.

To calculate your salary simply enter your gross income in the box below the GROSS INCOME heading select your income period default is set to yearly and press the Calculate button. Please note where a net salary has been agreed the employer will be covering the employees pension contribution in addition to. To accurately calculate your salary after tax enter your gross wage your salary before any tax or deductions are applied and select any conditions which may apply to yourself.

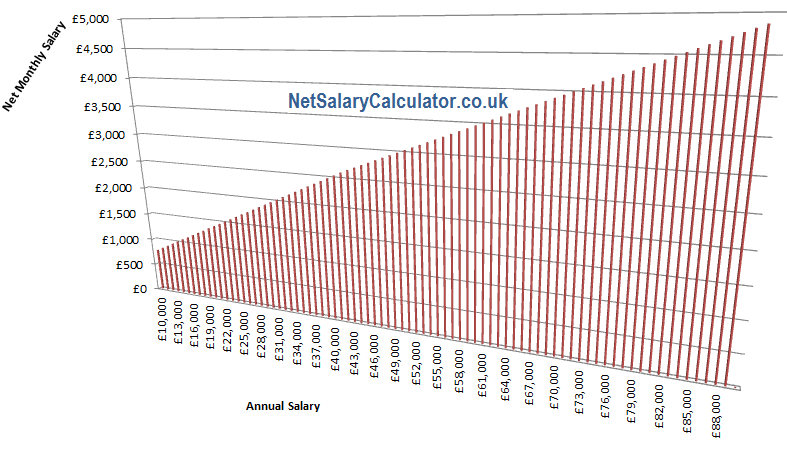

The UKs income tax and National Insurance rates for the current year are set out in the tables below. The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan. The gross to net salary calculator below outlines the salary after tax for every level of gross salary in the UK.

Find out the benefit of that overtime. UK Salary Calculator Our salary calculator will provide you with an illustration of the costs associated with each employee. The latest budget information from April 2021 is used to show you exactly what you need to know.

This article was published on 7 Oct 2020. Enter the net wage per week or per month and you will see the gross wage per week per month and per annum appear. Why not find your dream salary too.

If you are earning a bonus payment one month enter the value of the bonus into the bonus box for a side-by-side comparison of a normal month and a bonus month. We offer you the chance to provide a gross or net salary. Enter the gross wage per week or per month and you will see the net wage per week per month and per annum appear.

To use the tax calculator enter your annual salary or the one you would like in the salary box above. Your gross hourly rate will be 2163 if youre working 40 hours per week.

Comparison Of Uk And Usa Take Home The Salary Calculator

Net To Gross Salary Calculator Stafftax

Download Uk Salary Tax Calculator 2021 Free For Android Uk Salary Tax Calculator 2021 Apk Download Steprimo Com

Uk Salary Calculator Template Spreadsheet Eexcel Ltd

Visualisation Of Salary Deductions The Salary Calculator

26 000 After Tax Salary Calculator Uk

Income Tax Co Uk Uk Tax Calculator Home Facebook

Uk Income Tax Calculator July 2021 Incomeaftertax Com

2012 2013 Net Salary Calculator Gross To Net Pay

Comparison Of Uk And Usa Take Home The Salary Calculator

The Salary Calculator Pro Rata Tax Calculator

Salary Calculator Isgoodsalary

Uk Salary Tax Calculator 2021 2022 Calculate My Take Home Pay

Ask Sage Income Tax Paye General Information And Manual Calculations

Ask Sage Income Tax Paye General Information And Manual Calculations

50 000 After Tax 2021 Income Tax Uk

Post a Comment for "Gross Salary Calculator Uk"